How Buy-Sell Agreements and Key-Person Insurance Policies Can Save Your Business

As an insurance agent, my brain is trained to think in terms of the worst-case scenario. My wife reminds me that this makes me really fun to be with at parties, as I am constantly identifying all the emergency exits, trip hazards, and other exciting dangers (insert eye roll here).

But humor me and my tendency to catastrophize for a few minutes, if you will, and imagine this: a key member of your team, someone with critical skills and experience, maybe even your business partner or co-founder, suddenly passes away. Sales grind to a halt. Clients are confused. Projects stall. Income takes a hit. How long before you would be ready to go back to work? The next day? Next week? Next month? Never? Income issues aside, when you are delivering goods and services in a high-stakes environment, you are afforded very little time to grieve.

This scenario would be devastating, for sure, but thankfully there are tools to mitigate the impact and, quite possibly even save your business.

Buy-Sell Agreements: Ownership in Flux

A properly arranged and funded buy-sell agreement is perhaps the most effective way to help protect all interested parties in the event of the death or disablement of a partner. Buy-sell agreements are legal contracts that establish business succession plans in advance, including a right to purchase the deceased or disabled owner’s share of the business, and determining the value of that share of the business.

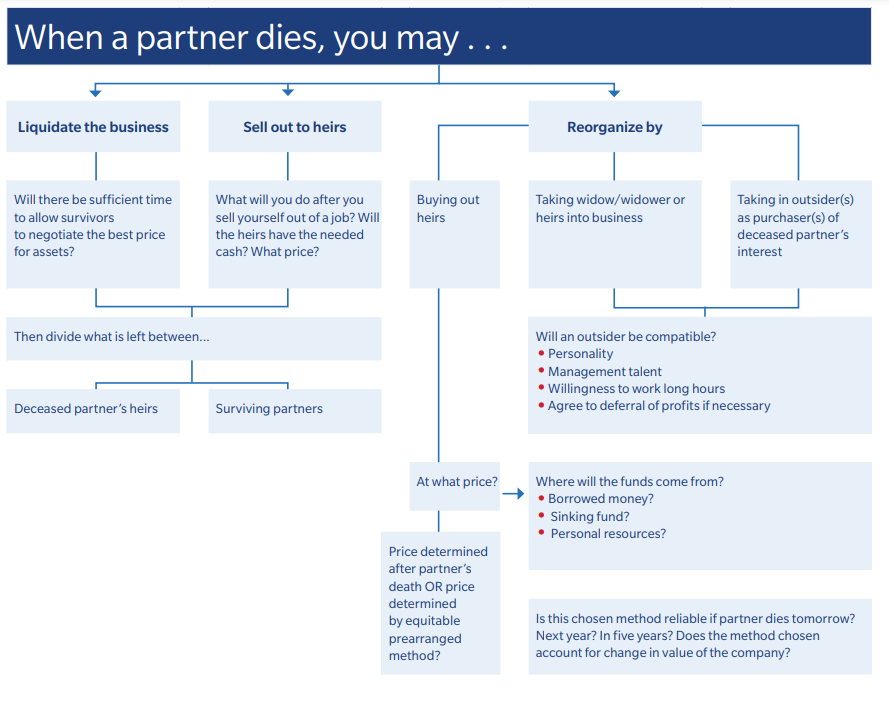

The chart below illustrates the litany of decisions that need to be made without a funded buy-sell agreement in place.

Most businesses have a buy-sell agreement in place. (If you don’t, contact your favorite business attorney to get one drawn up!) But the next question that must be asked is, “How will it be funded

Imagine again, on top of the shock and grief of losing a trusted business partner, now you have to come up with the capital to buy out your partner’s shares at the agreed-upon value. If you don’t, you just might suddenly find yourself in business with their heirs!

Life insurance for the business partners or owners is one common way that can help provide the funds to execute a buy-sell agreement if one of them dies. This can literally be the difference between your business continuing under your leadership (if that’s what you choose) or you giving up control of what you have worked so hard to build.

A funded agreement can, for example:

- Help provide heirs and survivors with financial security

- Smooth an ownership transition

- Strengthen the business’s future credit position

- Help provide continuation of business

- Maintain the value of a successful business

Key Person Insurance: Protecting Your Business Operations

Key person insurance goes beyond owners and partners, shares and buyouts. It protects the business itself from the financial hardship caused by losing a critical employee. The death of a key salesperson, for instance, could cause a significant drop in revenue. Are you ready to personally make up for that rockstar’s sales? Or in my agency, I would be LOST, I tell you, without my customer service representative. I’d have to hire and train someone pronto, or maybe even consider outsourcing the service for a while – both of which would come at a huge unexpected cost.

With a key person insurance policy, the business pays the premiums on a life and/or disability insurance policy for that key member. If the key person dies, the insurance provides a payout that can be used to hire and train a replacement, cover lost revenue, or maintain client relationships. Or again, maybe the proceeds of the policy allow you and your team the necessary time to grieve, without the added stress of lost income.

In short, funded buy-sell agreements and key person insurance policies can work together to safeguard your business during a critical time, or in that worst-case scenario that I am always imagining. They provide financial stability, ensure ownership continuity, and minimize disruption, allowing your company to weather the storm and keep moving forward.

If you co-own a business or have key personnel crucial to your operations, consider consulting with an attorney, financial advisor, and insurance professional to explore how to safeguard your company’s future.

Why key person insurance is important:

- ensure ownership continuity

- protects the business itself from the financial hardship caused by losing a critical employee

- Allows you and your team time to cope, without the added stress of lost income

- supplement lost revenue until a new person is hired; If the key person dies, the insurance provides a payout that can be used to hire and train a replacement, cover lost revenue, or maintain client relationships

- Safeguards your company’s future – lessens this stress for you

Thank you to our BrainTrust Champion, Jason Egly of The Egly Agency for his contribution to this bog.